The once-in-a-generation experience of 2008’s Global Financial Crisis – and the carnage it left in its wake – has been etched in our collective memory.

Its effects on the UK housing market were severe, with the average house price collapsing by 20% in 16 months and transaction levels plummeting from 1.65 million per year to 730,000 in the year up till June 2009.

The UK housing market was fundamentally reshaped for homeowners and investors alike: hopping onto the housing ladder became heavily dependent on the “Bank of Mum and Dad” and the halcyon days of NMLI deals disappeared, as lenders morphed from Santa to Scrooge, overnight.

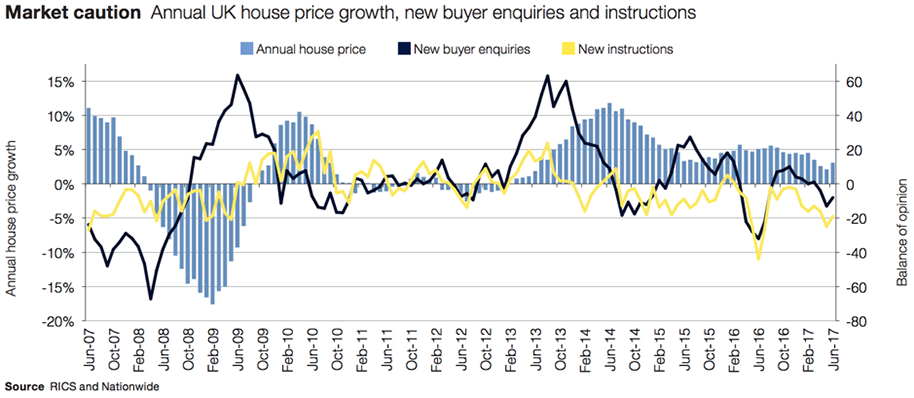

While the last decade has seen a bounce-back in values, for the most part, indicators across the board are now blinking red, pointing to a resetting of the cycle.

In this piece, we outline some of these downcycle indicators and reveal a new red flag that came to our attention in recent weeks, and we’ve been monitoring since. It could have immediate implications for your portfolio and cash flow…

Booms, Busts & Brexit

While the anticipated collapse of the economy since the Brexit referendum hasn’t materialised (yet?), as we creep closer to March 2019, the general level of uncertainty has clearly kicked up a gear.

Even a quick glimpse at the newsstands is enough to notice headlines warning of trouble brewing beneath the surface.

Of course, one should bear in mind that headlines are sensationalist by nature, but this time, recently released stats seem to be backing them up:

- According to Nationwide’s latest figures, house price growth slowed to just 2%, its slowest pace in 5 years

- Recently, Foxtons estate agent halved their dividend after reporting yet another quarter of tumbling profits, after a near 25% drop in property sales

- The National Association of Estate Agents’ data shows that 86% of properties sold for less than ask during March this year – the highest levels since records began in 2013

To make things even more precarious, on August 2nd the BOE unanimously voted to increase the base rate from 0.5% to 0.75% for only the second time in a decade, in order to keep inflation in check.

Most experts in the City envisage rates eventually heading up to a “new normal” in the 1.5%-3% range, which will put significant strain on the already struggling pocketbooks of property investors.

The Latest Red Flag?

A few weeks back, during the Victoria Derbyshire show on BBC 2, there was a 9-minute segment about a trend which has been accelerating quietly beneath the surface of the UK property market…

We hadn’t heard many investors talking about, so we felt we should let you know.

Over the last two years, there has been a significant rise in homes being valued by banks and building societies at less than what buyers have agreed to pay vendors – otherwise known as “down valuations”.

The upshot of this, for investors? Potentially ending up having to pay thousands of Pounds extra upfront, just to avoid a deal collapsing.

Russell Quirk, CEO of Emoov, one of the UK’s largest digital estate agents, observed that the number of sales resulting in a down valuation on his site has gone from less than one in twenty, to one in five (that’s an increase of over 400%) – the highest level since the GFC. Similar data was also observed by London and Country mortgage brokers.

The consensus amongst experts is that this conservative behaviour may be a sign that lenders are jittery about a potential near-term slump in house prices.

Quirk’s read of the situation was blunt:

“Surveyors are prophesying a crash and covering their backs…”

Consequences of Down Valuations

1. Deal Loss

Let’s say you’ve gone out and found a brilliant property to add to your portfolio: it’s in immaculate condition, the numbers stack and you’re set for a delicious annual ROI.

Happy with the setup of the deal, you agree to buy the property for £250,000.

At this point, your mortgage provider sends out a surveyor to value it and ensure the price paid represents market value.

While you might be willing to pay a smidge over the odds to secure the deal – the numbers stack, after all – this is no bueno for the lender, as it puts them at undue risk.

After looking at the sales prices of similar properties in the locality, market conditions in the area as well the general condition of your new purchase, the surveyor might conclude that the house is actually worth £235,000, £15,000 less than the sales price you’ve just agreed on – this is a “down valuation”.

At this point, you have a few choices:

- Try to negotiate the price down with the seller after having already agreed to £250,000 (good luck…)

- Find an extra £15,000 cash up front, to plug the hole

- Try to get a mortgage from another lender, a different surveyor may value the property higher, but this will incur new mortgage fees (and massively delay the process)

- Appeal the valuation, but surveyors don’t often change their opinions, and you’d need to come up with extremely strong evidence to make your case

If you can’t do any of those at short notice, you lose the deal after all that work – down valuations are a leading cause of chains breaking. The reverse also applies if you’re trying to offload any properties from your portfolio.

2. Remortgaging Risks

Another subtlety to this phenomenon is that down valuations don’t just affect investors at the buying/selling stage.

If you’ve bought an investment property with the intent of adding value and remortgaging, you too could be at risk of being down-valued.

Having your property valued potentially tens of thousands of pounds below your initial estimates could be enough to throw the deal from profitable to barely breaking even, or worse. It could also result in your mortgage payments going up, as the value of your equity has dropped.

What would be the consequences if you’re relying on pulling out the cash from a remortgaged property to fund other projects in your portfolio and suddenly you can’t get it?

Managing cash flow is critical.

If a boiler blows up or a roof caves in at one of your properties and you need to fork over thousands to get them sorted, having down valuations syphoning money from your Rainy-Day fund can put you in a very precarious position.

Down Valuation Protection Tips

At Walton Maslow, our ethos when sourcing deals for our clients from day one has been to make sure we build buffers into all our numbers and show our clients how to maximise ROI via our network of contacts and toolbelt of strategies (more on that later).

Below are three tips we think will help improve your chances of sidestepping a DV:

1. Get Clear on What It’s Worth

It’s very easy to go and view a property based on the listed price, decide that you’ll haggle a couple thousand off and leave it at that. In a bull market this can work fine, but with this down valuation trend, not doing your homework before you make an offer could cost you instantly.

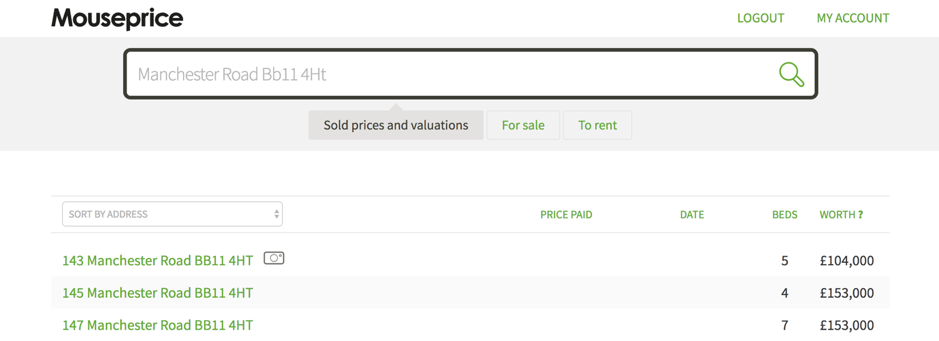

Net House Prices and Mouseprice are good starting points for estimating how much the property you’re going to view is really worth.

Net House Prices pulls data from Land Registry to show sale price history (great for finding comps). Mouseprice also has a proprietary valuation tool that suggests (it’s not fully accurate, obviously) the current market value.

Once you have an idea of the real value of the property, you can protect yourself from potential downside by negotiating the purchase price to something that makes sense.

Make the vendor aware that it’s a buyer’s market: if they’re not willing to negotiate on price, move on.

If you purchasing your investments with a big enough discount, the equity buffer you have will shield you from price declines.

2. Get a Solid Handle on Potential Rental Income

Relying on the word of the estate agent trying to sell you the house for rental income estimates, is asking for trouble.

One “trick” we like to use when stacking our deals, is to call an agent pretending to be a potential tenant looking to rent a property on or near that street. We find that the number they give is usually lower than the number we’d received when we told them we are landlords (fancy that!). The true number is likely somewhere in the middle.

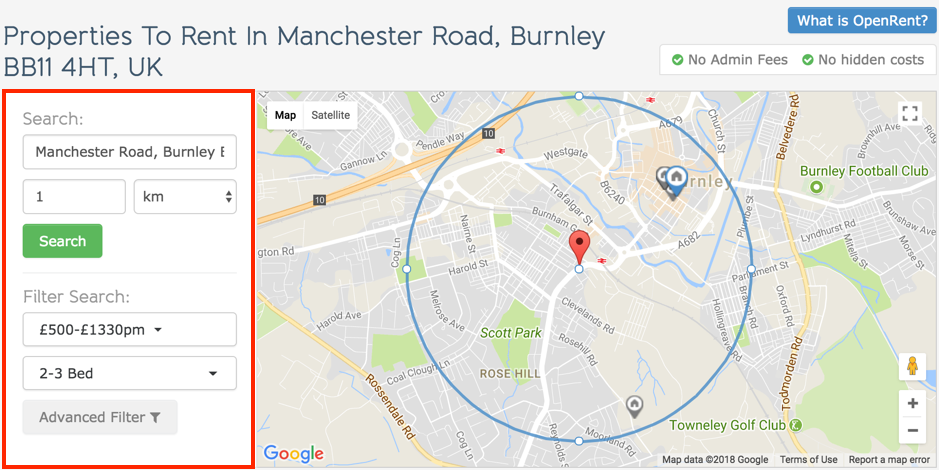

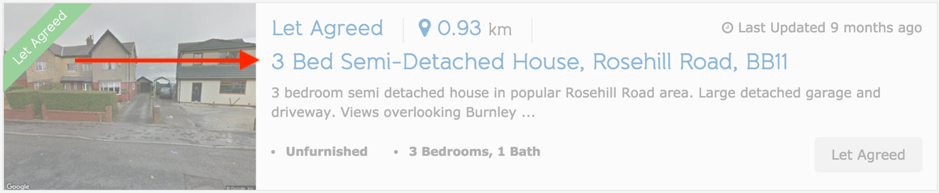

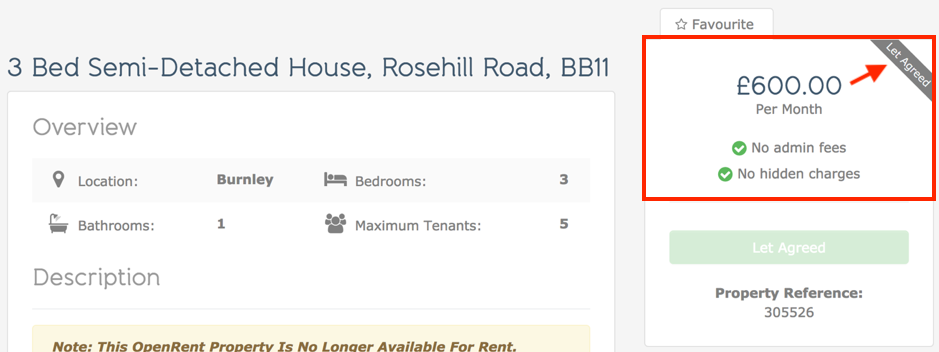

Another option is to look at data which shows exactly how much tenants have agreed to pay on properties that are similar to your own. For this, we use the “Let Agreed” section on OpenRent, like so:

Step 1: Head to Openrent.co.uk, and enter the address of the property

Step 2: Tweak the distance, desired rent and bedroom number settings to match the property you’re researching

Step 3: Scroll down the page to the greyed-out listings – these are “Let Agreed”, i.e. confirmed, lettings which give definitive indications as to what you could hope to achieve for a similar property

3. Manage Costs and Leverage Creative Financing

We spend a lot of our time thinking about ways to add value to our deals, so Walton Maslow’s investors get the most out of them.

One way we do so is by providing our clients with a range of strategies to maximise cashflow and minimise tax liability – the impact on their ability to increase ROI and build their portfolios more aggressively is a joy to behold! Though game-changing, the specifics of those strategies are a little too involved for this write-up, but I did want to give you a tip which you can use right away…

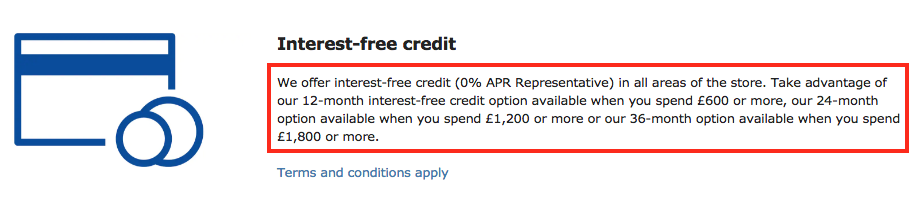

Did you know that IKEA offers interest-free (yes, that’s 0%) credit on furniture purchases over £600?

If you were to spend £3,000 outfitting your HMO, for example, you’d be eligible for their 36-month plan.

That would boil down to £83.33 per month (which your tenants pay), giving you two major benefits:

- Increased Rent Potential: With the financing, you can spend more than usual for a higher standard of finish without huge cash outlay. This, in turn, means you can command higher rents than your competition in the area.

- A Heavier Wallet: You keep that additional £2916.67 cash in your pocket for the deposit on another deal!

The Bottom Line

This down valuation trend is just one in a catalogue of mounting issues for investors.

With changes in buy-to-let taxation… increased stamp duty… mandatory licencing… interest rate hikes… and more, deals are getting trickier to stack and investors are feeling the squeeze.

I omitted Brexit from that list, because soft Brexit, hard Brexit or no Brexit, these changes are structural and aren’t going to change soon.

It’s becoming more important by the day, to be pernickety with your numbers and especially selective with your deal sourcers – they need access to: (i) great deals, (ii) solid teams and (iii) creative financing strategies that can drive down your costs, improve tax efficiency and maximise your ROI.

It’s not all doom and gloom though!

We’re of the opinion that the next few years could be the buying opportunity of the decade – if you’re ready and know what you’re doing. It’s likely we’ll see the property market flooded by investment properties for sale, driving a dip in prices – i.e. discounts for all.

Just make sure that in the meantime, you’re disciplined, are getting maximum bang for your buck and focus on building your cash reserves for those incoming sales.

Want to become a Walton Maslow Property Partner? Gain access to our hand-selected investment opportunities: Join Us.